House Republicans want to roll back a $27 billion “green bank,” the largest grant program in the massive spending bill dubbed the Inflation Reduction Act and passed in August by the Democrat-controlled Congress.

Rep. Gary Palmer, R-Ala., chairman of the Republican Policy Committee and a member of the House Energy and Commerce Committee under the new GOP-controlled House, introduced legislation to get rid of the “slush fund” set up for use by President Joe Biden. The House panel plans to mark up the bill next week.

“There is a lack of accountability. This was done in the dark of night,” Palmer told The Daily Signal. “It’s a slush fund meant to benefit one constituency, but not anyone else. There will be a lot of cronyism.”

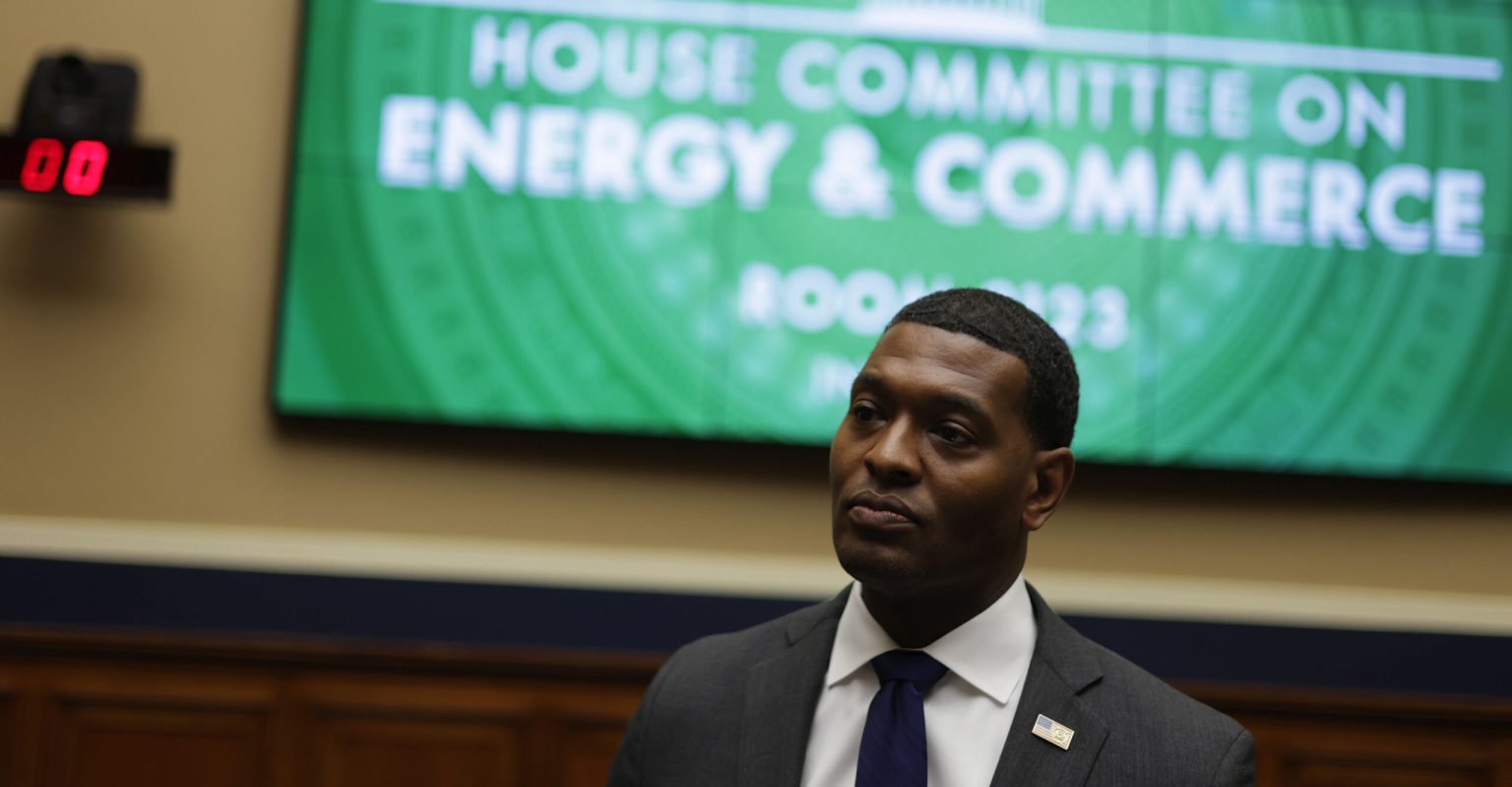

Earlier this month, the Environmental Protection Agency announced the early stages of grants for the green bank, formally called the Greenhouse Gas Reduction Fund.

The fund was designed to set up two pots of money, $20 billion for the General Assistance and Low-Income and Disadvantaged Communities Program to be divided between two and 15 recipients, and $7 billion for the Zero-Emissions Technology Program to be divided among 60 recipients.

“The initial program design announced today will ensure the fund fulfills its mandate to deliver benefits to all in a transparent and inclusive fashion,” EPA Administrator Michael Regan said in a Feb. 14 statement.

“With $27 billion from President Biden’s investments in America, this program will mobilize billions more in private capital to reduce pollution and improve public health, all while lowering energy costs, increasing energy security, creating good-paying jobs and boosting economic prosperity in communities across the country,” Regan added.

How Green Bank Works

In its Feb. 14 announcement, the EPA said the agency expects to open competitions for funding from the two programs under the Greenhouse Gas Reduction Fund by this coming summer.

The grants will have to align with the Biden administration’s Justice40 Initiative, which requires that 40% of overall spending from a federal initiative go to “disadvantaged communities,” which the administration defines as “marginalized, underserved, and overburdened by pollution.”

“It doesn’t help disadvantaged communities where 20 million households are behind on their utility bills,” Palmer said.

The $7 billion pot is reserved for states, municipalities, tribal governments, and nonprofit organizations. The goal is to leverage private funding, according to the EPA. This money will be used “to enable the deployment of residential rooftop solar, community solar, and associated storage and upgrades in low-income and disadvantaged communities,” the agency says.

The $20 billion pot is reserved for nonprofits “that will collaborate with community financing institutions like green banks, community development financial institutions, credit unions, housing finance agencies, and others,” according to the EPA.

Of that pot, $8 billion will be for low-income and disadvantaged communities in alignment with the Biden administration’s Justice40 Initiative, and primarily will involve nonprofit organizations.

The Environmental Protection Agency did not respond directly to The Daily Signal for this report.

‘Reminds Me of Solyndra’

No money has gone out yet. But the Coalition for Green Capital, an advocacy group, has identified multiple projects that could use funding from both grant pots on Day One.

These projects include $50 million for renewable projects in affordable housing in New York; $28 million for affordable housing with solar panels in Texas; $20 million for building an electrification project in Connecticut; $15 million for residential energy efficiency projects in California; $14 million for a “smart meter” project in Hawaii; and $10 million for so-called resilience, solar, and efficiency projects in Florida.

“This will just be solar panels on rooftops,” Palmer said. “Renewables don’t last forever. In fact, they have a short lifespan and are expensive to replace.”

Palmer said he fears that the EPA’s green bank will result in something like the $535 million loan made by the Obama administration to the politically connected solar power company Solyndra, which ended up going bankrupt and was investigated by the FBI.

“This reminds me of Solyndra. That was $500 million down the tubes,” the Alabama Republican said.

Moreover, Palmer noted, this effort would boost America’s top adversary.

“For solar panels, 70% of materials come from China. We don’t have a lot of rare earth elements,” Palmer said.

Implementing the Green Bank

However, even supporters of the Greenhouse Gas Reduction Fund question whether it can be implemented effectively, namely EPA employees.

Earlier this month, the EPA employees union—AFGE Council 238, which represents about 14,000 employees—briefed members of Congress about the burden of a staffing shortage when the agency’s mission is being expanded.

“Implementation of the Inflation Reduction Act (IRA), the Bipartisan Infrastructure Law (BIL) and EPA’s fiscal year 2023 funding increase will not be meaningful if EPA staff is so overburdened that they cannot bring home benefits to the American people,” the union says in a memo to lawmakers.

The memo adds: “Our mission has grown enormously, and climate challenges continue to escalate, but EPA’s ability to hire and retain staff is at a crisis point. In the past year, Congress has added many new responsibilities to EPA’s plate.”

Meanwhile, the cost for reaching the Biden administration’s goal of net-zero carbon emissions by 2050 will be $275 trillion, according to a report last year from McKinsey & Co.

“The U.S. share of that is $22 trillion to $28 trillion,” Palmer told The Daily Signal. “You have to ask yourself what is a $27 billion bank going to accomplish, other than the devastation of local economies?”

Long-Standing Goal for Left

A national green bank, or climate bank, long has been a goal for the Left, with Rep. Debbie Dingell, D-Mich., proposing bills to establish such a bank in the 116th Congress and again in the 117th Congress.

“The $27 billion in the Inflation Reduction Act for a national Greenhouse Gas Reduction Fund is the single largest investment in clean energy, environmental justice, and carbon pollution reduction in American history,” Dingell said in a prepared statement Feb. 14. “We have proven green bank models nationwide, including in Michigan, that not only mobilize investment directly into the most critical projects, but are creating incredible economic opportunity, with good-paying, high-value jobs.”

However, Dingell’s past climate bank bills at least provided for an audit board and risk management committee to address accountability concerns, Palmer noted. The language in the Inflation Reduction Act provides few accountability measures, he said.

A 2021 research paper by the National Academies of Sciences, Engineering, and Medicine, “Accelerating Decarbonization of the U.S. Energy System,” asserted that about $30 billion in government funding would be required to achieve desired targets for reducing carbon emissions.

“Private sources of capital are unlikely to be sufficient to finance the low-carbon economic transition, especially during the 2020s when the effort is new,” the National Academies paper says. It continues:

Partial financing by a Green Bank would reduce risk for private investors and encourage rapid expansion of private sources capital. To better align the economy with the risks and benefits of transition policies and climate change, the committee includes a policy to require annual Securities and Exchange Commission (SEC) reporting of these risks and benefits by private companies and their inclusion in stress tests by the Federal Reserve and in all cost-benefit analyses by federal agencies.

Green Banks on Smaller Scale

Similar green banks in the United States have spent $2.5 billion in addition to $6.5 billion in private sector money, Reed Hundt, co-founder and CEO of the Coalition for Green Capital, told Canary Media in August.

New York state’s NY Green Bank is the nation’s largest such bank. Washington, D.C., established the first green bank for a city in the United States. Connecticut Green Bank and the nonprofit, Florida-based Solar and Energy Fund have functioned as green banks, Canary Media reported.

More than 30 such institutions operate either as public or private entities, according to the American Consortium of Green Banks, which is aligned with the Coalition for Green Capital. California and Vermont each have three such institutions, while some other states have more than one.

Traditionally conservative-leaning states such as Texas, South Carolina, and Missouri even have some form of a green bank, according to the consortium.

Connecticut Green Bank, the oldest green bank in the U.S., has worked with environmental groups in the state to create an appropriate “scorecard,” according to an article published early this month in Inside Investigator by Chris Herb, president and CEO of Connecticut Energy Marketers Association.

“With efforts to electrify the economy, one environmental group is currently working to create an environmental scorecard for every single house in the state,” Herb wrote. “So far, Connecticut Green Bank has color-coded almost every house in 78 out of the 169 towns in the state.”

“It’s a massive project which includes documenting what kind of fuel you use; what materials were used to build your home; what materials are in your walls, and even if you use air conditioning units in your windows,” Herb added.

In Britain, a green bank established in 2012 came under heavy scrutiny from Parliament’s Public Accounts Committee after an Australian bank bought the British green bank in 2018. The committee determined the government didn’t measure whether the green bank had achieved climate objectives. The committee accused the bank of a “deeply regrettable” failure, The Guardian reported.

Have an opinion about this article? To sound off, please email letters@DailySignal.com and we’ll consider publishing your edited remarks in our regular “We Hear You” feature. Remember to include the url or headline of the article plus your name and town and/or state.

Read the full article here